When it comes to automated invoice processing —AP automation—a lot has changed for mid-market companies since we first started following the Levvel Research (formerly PayStream) annual payables report several years ago. For one, automation is being adopted more widely, particularly by mid-market firms. We have noticed this exponential adoption trend at Yooz.

At the end of 2018, it was apparent that finance and accounting professionals are now accepting that AP automation is a good thing, not something to be afraid of. That is certainly a big shift from the prior year.

Another indication of the trend towards automation is the sheer exponential growth and demand for solutions that were previously only accessible by enterprise firms. This has resulted in an increased level of interest and ultimately adoption by mid-market companies. We witnessed this trend first-hand during our panel session at the Sage Intacct Advantage 2018 conference where the questions from the session attendees were thoughtful, educated, and more advanced than even just since last year. Finance and accounting professionals are better prepared when searching for AP automation providers and better able to articulate their needs, business goals, and expected results.

Trends in Invoice Workflow Automation

One of the most compelling opening remarks in the Levvel Research 2019 Payables Report lies in the report’s executive summary, which I think is a perfect representation of the direction that AP automation is going:

“One of the most effective ways to improve an organization’s bottom line is to decrease the cost of operations that do not directly contribute to profit, redirecting the freed resources towards strategic, profit-generating initiatives. Automating accounts payable (AP) processes is a perfect example of this opportunity, as it not only reduces the footprint of a high-cost administrative department, but it also creates an opportunity to generate revenue through increased efficiency."

Mark Brousseau, Institute of Finance Management (IOFM) AP automation subject matter expert, speaker, and consultant agrees. In a later podcast he talks about the future of AP automation stating how unrecognizable it will become from the way it was in 2019. AP automation will unlock value to help larger corporate objectives with digital, data driven and strategic results.

This restates the idea we have been introducing into the AP automation market since almost the beginning of our business: Essentially that you can turn the AP department into a “profit center” and impact the bottom line. And human resources can become more strategic, shifting from a “data-entry” role to more strategic responsibilities, like negotiating early payment discount thanks to the shortened cycle time. This is part of our mission statement and we talk about it a lot in our customer communications, educational webinars, and researched-based reports.

How AP Automation is Evolving

Now we look more specifically at how AP automation is evolving based on the Levvel Research 2019 Payables Insight Report and how Yooz is keeping up with—even staying ahead of—the technology curve.

In many areas, mid-market firms are still experiencing the same pain points as they were in recent previous years, according to the Report. Manual data entry and inefficient processes and manual routing of invoices for approval still top the list, as they did in the survey conducted for the 2018 report. This falls in line with the indication that firms are still receiving nearly half of their invoices in paper form rather than electronic or EDI.

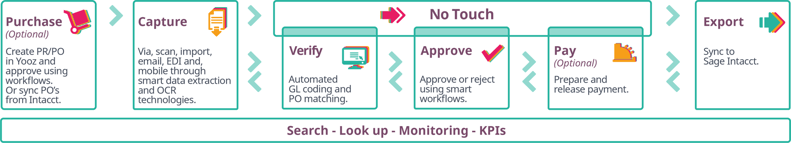

And mid-market firms are eliminating these pain points by automating AP workflows, creating a touchless invoice and payment processing environment.

It’s working. Organizations are experiencing reduction in paper invoice volume and quicker approval of invoices as a result of automating.

One thing that is dramatically on the upswing is cloud technology in AP automation. According to the 2019 Report, awareness of the value of cloud-based AP automation tools is growing, as is demand.

They are the most versatile and scalable options available today for organizations across revenue segments, business types, and industries because they are increasingly flexible, dynamic, and affordable.1

The adoption of cloud-based automation tools has greatly increased in 2019 over 2018—more than doubled, in fact, from 22% to 49%.

One of the trends that the Yooz cloud-based AP automation solution has been on the forefront of compared with other providers in the market (“the other guys”), is on the importance of OCR (optical character recognition) to intelligently automate data capture. More than half of the survey respondents in mid-market firms claim OCR as an important feature of the AP automation tool. OCR, powered by AI, is inherent to the Yooz solution, where many providers claim to have OCR technology, but in reality outsource to a third-party.

Technology Trends Driving Expectations

Next, we’ll continue our breakdown of the Payables Insight Report with an overview of technology trends that are driving expectations of finance leaders as they explore options for invoice and payment processing (AP) automation solution providers. It starts with finance and accounting professionals in all sizes of organizations being more aware than ever of intelligent technologies in relation to AP automation—one-third of those surveyed, in fact2.

OCR: One of the trends that the Yooz cloud-based AP automation solution has been ahead of is developing OCR (optical character recognition) / automated data capture as a critical technology feature of our platform. More than half of the survey respondents in mid-market firms claim OCR as an important feature of the AP automation tool. OCR, powered by AI, is inherent to the Yooz solution.

A key feature of OCR that contributes to the ease-of-use is advanced data entry technology. Combined with machine learning (ML) capabilities powered by AI, the system intelligently fills in, for example, recurring fields from similar vendors or invoice information such as date or payment type. ML capabilities improve over time as an algorithm learns the invoicing patterns of an organization. In other words, the system gets smarter the more you use it! In this way, OCR can ensure a high level of accuracy.¹

And our technology is even more advanced with smart data extraction, which understands and takes the text pulled from the OCR to transform it into relevant data by placing it in the correct fields. As you are exploring AP automation providers, you may ask, “Do you have OCR technology?” But what you really want to know is if the solution has a complete technology, combining OCR, smart data extraction, and machine learning powered by AI.

When researching AP automation solutions you should beware of those providers that use OCR but don't have smart data extraction as well. Often times these solutions will outsource this part to a third party where someone manually does the extraction and verification. This is often called third-party verification. When the data entry is done by an outsourced third party it takes time as the data is being populated by people, typically 24 to 72 business hours. This defeats the purpose of moving from a manual AP process to an automated process to save time.

PO Matching: Another crucial capability of advanced AP automation—also called ‘invoice workflow automation’ or IWA—is purchase order (PO) matching, which involves automatically linking invoices to purchase orders or other receipt documents.

Then the system routes the invoice to the appropriate approval chain based on predefined business rules. The most advanced solutions take this one step further, providing field-level matching, meaning that they match specific characters in invoice line items with their counterparts in the POs.

Reporting and Analytics: Whereas in recent years the focus on AP automation was in making the AP process more efficient, saving time and money along the way, now reporting capabilities in AP automation solutions like Yooz help finance leaders and their teams be more strategic. Reports summarize spend activity and help managers and the C-suite to identify spending trends, optimize spend policies, and improve efficiency.

Mark Brousseau, consultant, Institute of Finance Management spokesperson, and speaker says that if finance leaders “can get at the information and data housed in their AP departments, they can use it to support better management of their working capital, mitigate potential risk, and make more strategic decisions”.

Benefits of Smart AP Automation Solutions

We reviewed technology trends that are driving expectations of finance as they explore options for invoice and payment processing (AP) automation solution providers.

To wrap this up, we’ll continue our breakdown of the Payables Insight Report with a look at how each stakeholder will specifically benefit from sophisticated AP automation solutions like Yooz that offer a complete end-to-end invoice and payment processing workflow.

AP Staff: It’s no secret that automated invoice and payment processing most directly impacts AP staff who are responsible for tedious tasks such as data entry and tracking down lost invoices. Automation lessens the burden of, even eliminates, time consuming, low-value tasks placed on AP clerks and accountants, as well as reduces the costs of paper-based activity.

When it comes to automating payments, solutions like Yooz, seamlessly integrated with more than 200 ERPs, push invoices to financial systems for payment, reducing the need for time-consuming tasks such as paper check processing. The solution can even handle payment reconciliation and data maintenance tasks.

Mid-level Managers: Alerts and custom controls reduce the time necessary for middle and upper management to oversee approvals. Invoice management solutions also record entire workflow histories, which helps in identifying errors and ensuring a smoother audit process.

At the payment processing stage of complete end-to-end solutions like Yooz, mid-level and upper management staff see a great reduction in maverick spending, fraudulent payments, and security concerns that result from less controlled payment methods like printing and mailing paper checks.

Executive Management: C-suite execs can spend less time addressing discrepancies or solving disputes, and can instead focus on strategic initiatives, such as more accurately forecasting cash, managing budgets, and mitigating risk, as we heard from Mark Brousseau earlier. All helping drive larger corporate objectives.

Those at the C-suite level will see the cost savings resulting from reduced invoice approval times and increased early payment discount capture. More bottom line improvements happen at the payment processing stage when executive leaders can strategically manage payments and optimize cash flow. And then they can take that capital and invest it into things like R&D and new product development.

Finally, with advanced reporting capabilities, C-suite are able to identify spending trends, optimize spend policies, and improve efficiency. Reporting dashboards give visibility into potentially fraudulent activity, spend occurring out of company policy, employees who are delaying invoice approval workflows, and suppliers that frequently send duplicate or incorrect invoices.

The insights generated by advanced reporting and analytics tools aide C-suite professionals in targeting trouble spots and provide a holistic overview of the organization’s cash flow.

FAQs

How does Yooz's invoice workflow automation streamline the invoice approval process?

Can Yooz's invoice workflow automation adapt to our organization's unique approval hierarchies and business rules?

How does Yooz ensure accuracy and compliance in the invoice approval process?

Can Yooz's invoice workflow automation integrate with our existing ERP or accounting systems?